This article explains each step of the dispute process, and how to provide the correct information to improve your chances of winning the disputes as well as reducing your chances of receiving disputes.

1. What is a dispute?

A dispute occurs when a cardholder disputes a charge with their bank which was made to their credit/debit card for the booking of a product/service. It is a reversal of a payment initiated by the customer

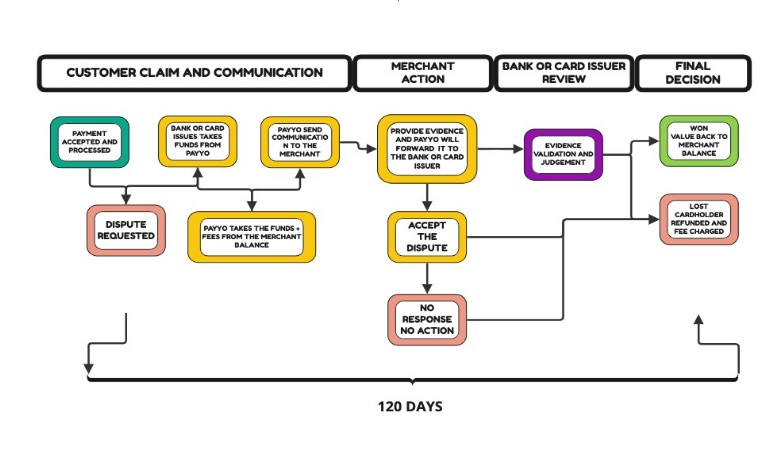

What is the process when a dispute is received?

When a dispute is received, the amount is immediately deducted from the merchant’s Payyo balance by the card issuer and placed on hold until the dispute has reached a conclusion. Payyo will then contact the merchant and request further information to confront the claim.

- Reason for the dispute

- Booking ID

- Deadline for responses

- A link to the Payyo support pages for more information

Payyo acts as an intermediary between the merchant and the customer’s bank/credit card company.

A dispute can be opened for various reasons.

Dispute Lifecycle

- Payyo receives a notification from the acquirer that the cardholder has opened a chargeback.

- The money is immediately returned to the card issuer. The transaction amount will be deducted from the merchant’s balance.

- Payyo notifies the merchant by email to contact the customer and send us any relevant information and correspondence that could be used to help dispute the claim.

- Payyo will forward any relevant information received to the issuing bank for their review.

- The card issuer will review the information and inform Payyo of the outcome

- Payyo notifies the merchant of the outcome

If the merchant does not reply within 3 days, the chargeback is treated as accepted and the dispute is marked as “lost”.

There are two possible outcomes of the dispute:

LOST: If the decision is closed in the cardholder’s favour, a dispute will be marked as lost and the money will be returned to the cardholder’s account. A fee will also be added to the merchant’s account.

WON: If the information provided was sufficient to dispute the cardholder’s claim, the case will be marked as won and the funds will be returned to the merchant’s balance.

The Dispute lifecycle

Understanding the dispute reasons and how to proceed

It is important to understand the reasoning for a dispute. There are several reasons why a dispute can be opened.

Not Authorized or Not Recognized

These disputes occur when a cardholder claims that they did not authorize a transaction or does not recognize a transaction on their credit card statement. The merchant must provide evidence that the cardholder did authorize the charge in order for the dispute to be resolved in their favor.

Unsatisfactory Products or Services

These disputes occur when a cardholder claims that they received a product or service that was defective, not as described, or not of the quality that was expected. The merchant must provide evidence that the product or service was exactly as described for the dispute to be resolved in their favor.

Refund Not Issued

These disputes occur when a cardholder claims that they have requested a refund from the merchant but have not received one. The merchant must provide evidence that the requested refund was invalid for the dispute to be resolved in their favor.

Service Not Provided

These disputes occur when a cardholder claims that they did not receive a service they paid for. The merchant must provide evidence that the service was received in order for the dispute to be resolved in their favor.

It is essential to forward evidence to reverse the dispute. This includes cases where the cardholder claims to have canceled the dispute on their side.

By providing information to fight the dispute advises the card issuer that the merchant does not accept the case and they want to confront the dispute

What actions can be taken to reduce the number of disputes received and to protect the business?

***PLEASE NOTE: This information should be treated as a guideline and will not prevent disputes***

The outcome of a dispute is completely reliant on the information the merchant can provide. The more information provided, the higher the chances of winning the dispute.

As disputes are not completely preventable, we have listed some measures that could help reduce the number of cases that are lost:

- Upon arrival or before the service is provided, take a copy of the customer’s ID and get them to sign beside the photocopy.

- Always communicate with the customer and try open a dialogue with them

- If possible, try to verify the card details that were used at the time of the booking. The merchant receives the first 6 and last 4 digits of the card.

- Complete order forms, especially those outlining special requests.

- Regular communication logs between the merchant and the customer before and after the product/service have been received.

- Prove the cardholder received the product/service by taking photos, social media posts and tagging them, etc.)

Timeframes of customers, banks or issuers, and merchant

- How long does a cardholder have to open a dispute?

- This varies from the card issuer, but typically cardholders have up to 120 days from the transaction date or service date, whichever is most recent.

- What is the deadline for merchants to reply to the dispute communication?

- Payyo merchants have 48 business hours to reply to disputes communication, so if a dispute communication takes place on Friday at 4 pm the merchant has until Tuesday at 4 pm to reply to the dispute, in case of no reply the dispute will be closed due to merchant inactivity and the case will be closed in favor of the cardholder.

- How long does it take to have a conclusion after submitting the relevant dispute information?

- The card issuer can take up to 90 days after the dispute is filed. There is no possibility to speed up this timeframe.

- Getting in touch with your customer is crucial to speed up the process. As the cardholder has initiated the dispute, the request can also be closed from them at any stage. The cardholder must provide proof of dispute cancellation from their card issuer. Otherwise, it can take the full 90 days to receive the outcome of the dispute.

Disputes that can’t be confronted

SEPA Direct Debit and Cartes Bancaire

Direct Debit disputes Cartes Bancaire are a little different from regular disputes. The main difference is that they can not be challenged by the merchant and therefore, the dispute has to be accepted without further inquiry. The fee will be applied to the merchant’s account.

There can be several reasons why a customer disputes a Direct Debit transaction:

- The customer does not recognize the transaction on their bank statement or the transaction was fraudulent and the cardholder was not aware their credit/debit card was being used for this purchase.

- The service was not provided and a full refund was expected to be made to the cardholder. The cardholder may have canceled this and did not follow your T&Cs or maybe the refund was not issued.

- The service was not as expected/described in the description and a partial refund was expected from the cardholder.

Please contact the customer immediately to clarify the reason for the chargeback. It is quite possible this could be a misunderstanding and can be resolved by contacting the customer directly.

The Direct Debit dispute time frames are a bit different:

Disputed within 8 Weeks: Customers are able to dispute a SEPA Direct Debit transaction on a “no questions asked” basis, meaning the funds will automatically be returned to them.

Between 8 weeks and 13 months: Customers are still able to dispute transactions during that period. The arbitration process involves both the acquiring bank and the customer.

After 13 months: Disputes are no longer possible.

2. Replying to Disputes

Review the dispute category

The reason for the dispute will be provided in the email. This information is important to know what further steps need to be taken, the most common reasons are:

- Not Authorized or Not Recognized

- Unsatisfactory Products or Services

- Refund Not Issued

- Subscription cancelation

Story Construction

The story construction is dependent on the reason for the dispute being opened. The information that needs to be provided is based on what the customer is claiming.

Not Authorized or Not Recognized

These disputes occur when a cardholder does not recognize the transaction on their bank statement. These disputes can be easily resolved by contacting the customer. If the customer is unresponsive or not willing to close the dispute from their side, further information will need to be provided to Payyo:

- Customer information such as full name, email, phone and address if applicable

- All customer correspondence such as email, whatsapp, social media, sms, etc

- Service or product details and description

Additional information can include:

- If you provided a service, create a photo dump for customers to upload photos of themselves partaking in the service. This can help prove they attended the service

- Tag customers on social media

- A link to the bookable product

- Ticket communication correspondence

- A link to the Terms of Service and Cancellation policy on your webpage

- Proof of product or service received by the customer such as scans, sign-in, signatures, etc.

- Evidence of service usage such as issue communication, scan logs, etc.

- Customer identification (if applicable)

Unsatisfactory Products or Services

These disputes occur when a customer does not receive the service or product which was advertised on the website when booking. These disputes can be easily resolved by contacting the customer. If the customer is unresponsive or not willing to close the dispute from their side, further information will need to be provided to Payyo:

- Customer information such as full name, email, phone and address if applicable

- All customer correspondence such as email, whatsapp, social media, sms, etc

- Service or product details and description

- A link to the bookable product

- Ticket communication correspondence

Additional information can include:

- If you provided a service, create a photo dump for customers to upload photos of themselves partaking in the service. This can help prove they attended the service

- Tag customers on social media

- A link to the Terms of Service and Cancellation policy on your webpage

- Proof of product or service received by the customer such as scans, sign-in, signatures etc.

- Evidence of service usage such as issue communication, scan logs, etc.

- Customer identification (if applicable)

Product/Service not received or Refund Not Issued

These disputes occur when a customer does not receive a refund which was either agreed upon with the merchant or stated in the cancellation policy. These disputes can be easily resolved by contacting the customer. If the customer is unresponsive or not willing to close the dispute from their side, further information will need to be provided to Payyo:

- Customer information such as full name, email, phone and address if applicable

- All customer correspondence such as email, WhatsApp, social media, sms, etc

- A link to the Terms of Service and Cancellation policy on your webpage

- Service or product details and description

- A link to the bookable product

- Ticket communication correspondence

Additional information can include:

- If you provide a service, create a photo dump for customers to upload photos of themselves partaking in the service. This can help prove they attended the service

- Tag customers on social media

- Proof of product or service received by the customer such as scans, sign-in, signatures, etc.

- Evidence of service usage such as issue communication, scan logs, etc.

- Customer identification (if applicable)

Subscription cancelation

These disputes occur when a customer cancels their subscription or recurring payment. This could be a misunderstanding or they have not followed the cancellation policy set out when signing up. These disputes can be easily resolved by contacting the customer. If the customer is unresponsive or not willing to close the dispute from their side, further information will need to be provided to Payyo:

- Customer information such as full name, email, phone and address if applicable

- All customer correspondence such as email, whatsapp, social media, sms, etc

- A link to the Terms of service and Cancellation policy on your webpage

- Service or product details and description

Additional information can include:

- Proof of product or service received by the customer such as scans, sign-in, signatures etc.

- Evidence of service usage such as issue communication, scan logs etc.

- Customer identification (if applicable)

- A link to the bookable product

- Ticket communication correspondence

Payyo and the card issuer need to understand the series of events that led to this dispute being received. It is crucial we receive any evidence and supporting documents which match the services of events laid out in your email. The merchant should always outline key information in their response email, such as:

- Customer information such as full name, email, phone and address if applicable

- Customer correspondence such as email, whatsapp, social media, sms, etc

- Customer identification (if applicable)

- Service or product details and description

- A link to the bookable product

- Ticket communication correspondence

- A link to the Terms of service and Cancellation policy on your webpage

- Proof of product or service received by the customer such as scans, sign-in, signatures etc.

- Evidence of service usage such as issue communication, scan logs etc.

It is important to remember, the more information provided will increase your chances of winning the dispute

Coupons and Vouchers instead of a refund

If pre agreements were made instead of a refund such as vouchers, changing dates of service, free booking on next visit or coupons for your website/partnering websites etc., the merchant needs to provide:

- All correspondence with the customer

- A copy of coupons or vouchers issued to the customer

- The cancellation policy specifications

- Any correspondence where the customer accepted the alternative option to a refund.

Please remember, credit card issuers will protect their cardholders first. If they believe the customer is entitled to their money back, regardless if a voucher has been accepted, they will close the dispute in the cardholder’s favor and the money will be returned to their account.

How to be more efficient in your dispute replies

- Provide all customer information

This shows the transaction was not fraudulent and the customer provided their own details

- All customer correspondence

This shows an open dialogue with the customer and they were aware of the booking of the product/ service

- A copy of the sales receipt or invoice

Providing a follow-up email after the booking is confirmed, including the date and amount of the transaction, can help customers identify the product/service and close the case from their side

- Proof of authorization

Any signatures, sign-in sheets, consent forms, etc., matching the customer details provided during the transaction.

- Terms and Conditions and Cancellation Policy

A link to the T&Cs displayed on your website as well as any documentation also outlining the T&Cs are important to prove what was agreed upon prior to the booking taking place. The T&Cs will normally include the cancellation policy.

- Logs of the Terms and Conditions

These can be very important to prove the T&Cs and also the cancellation policy was agreed to prior to the payment being made.

- Proof of delivery

Information such as tracking numbers or delivery confirmations and signatures.

- Any other documentation that supports the legitimize the transaction

When accepting a dispute claim

To know if the claim should be accepted and closed in the cardholder’s favor or not, there are some questions to be considered.

- After contacting the customer, did the reasoning for opening the claim become clear?

- Does the customer have valid reasoning for opening this dispute?

- Is the cardholder willing to close this dispute from their side

- If not, do you have valid evidence and information to confront this dispute claim?

Remember that when a dispute is opened the transaction can no longer be refunded as the value has already been deducted from your balance. The amount is held until a conclusion has been made.

To accept the dispute, please respond advising the claim is valid and the money should be returned to the cardholder’s account. To confront the dispute, please forward all correspondence and evidence to Payyo.

Accepting a dispute is an easy way to avoid any further issues which could damage your business image. However, this is not the most efficient way for the customer to receive their money back. There is a fee involved for all disputes and it also counts toward your merchant dispute rate which could affect future payments being processed through Payyo’s platform

Formats

File formats accepted:

- PDF, JPEG, or PNG

- Files can not exceed 10MB in size

- Maximum of 20 pages in portrait orientation (screenshots can be in landscape)

- Files can not be compressed in any form

- If possible add a description to each document

The organization is important to construct the story for the card issuer to understand your side of the story. Put information of the same type in groups and work them into a flow to outline a timeline of events from when the booking happened.

No other format is accepted by the bank or card issuer.

Videos in any format are not accepted by banks and card issuers. Links are preferred to recreate the booking process.

3. Things to note

Not all the information in this example is mandatory. The more information sent back to Payyo increases the chances of the dispute being overturned and the transaction amount will be returned to the merchant’s balance.

The evidence can only be submitted once. For that reason, the response needs to be detailed and precise. Remember, the more information provided by merchants increases the chances of the dispute being overturned.

Submissions made after the first reply will be disregarded by the bank or credit card issuer.

Keep the information and evidence relevant and to the point.

Dispute on refunded transactions

In this scenario, Payyo will inform the bank or the card issuer about the refund and also attach proof of refund. The dispute will be canceled before proceeding with any process. This will not affect your balance or dispute rate.

Please check if the refund was successful in the transaction area. If not, the refund will be rejected and a dispute process will take place.

Dispute on partially refunded transactions

These cases are common when the merchant has already refunded part of the transaction but a dispute was received for the full amount. Payyo will inform the card issuer of the partial refund and attach proof of refund. The amount in the claim will be adjusted accordingly.

It is still necessary to contact the customer if you do not agree with the dispute, especially if the transaction was partially refunded to avoid this situation. The process is the same as a regular dispute. Please check if the refund was successful in the transaction area. If not, the refund will be rejected by us and a dispute process will take place with the full transaction value.

4. Dispute conclusion and final decision

The conclusion can take up to 120 days after payment or service date. After the decision is made, the card issuer informs Payyo about their conclusion.

Payyo will mark the transaction as WON or LOST and it can be checked by you in your dispute area in the back office.

https://backoffice.payyo.ch/disputes.

Dispute Conclusion

If no response is provided by the merchant, Payyo will assume the merchant has accepted the dispute and the case will be closed in the cardholder’s favor and the money will be returned to their account.

If evidence has been submitted, Payyo will notify the merchant of the outcome.

The outcome is either WON or LOST. After receiving notification from Payyo, the information will be displayed in the transaction details as well as the dispute section in the Payyo back office.

The dispute outcome is final. The merchant can not reopen a dispute or reverse a lost dispute.

Dispute Fees

When disputes are lost, Payyo is charged a fee by the card issuer. Payyo will charge the merchant this fee in the case of a lost dispute.

- The fees are USD, EUR, CHF 20 or GBP 18.

In case of winning the dispute, no dispute fee is applied to the merchant.

5. Extra Useful Material

What is the dispute rate?

The dispute rate is a calculation made based on the total number of transactions compared to the total number of lost disputes received by the merchant.

- Ex. A merchant has 350 transactions and 2 disputes so the percentage of disputes over the transactions is 0.57% which is under the maximum allowed.

The dispute rate can not exceed 1% of all processed transactions. In the case the rate of 1% is reached, Payyo can take action to avoid any future issues. Firstly Payyo will do a deep dive into the transactions which could result in:

- Transaction blocking for specific regions

- Transaction blocking of IP addresses

- Blocking payouts

- Full risk review

- Blocked account