You are about to do the KYC process in the Payyo backoffice?

Here are some tips on what to keep in mind:

Do’s

- Pay attention to the information requested.

Please provide us with as much information as possible from the start. It will avoid a back and forward which can end up getting quite frustrating. - For business information, make sure to enter information on the system which matches the business registration document.

Believe us, we have seen a lot of mismatching KYC information. If you make sure the information you provide on the system matches with the information in your business registration document, it will make your life easier. - Always add a VAT number.

- Company phone number and representative phone number are always good to have as any issues, we will be able to reach out.

Payyo does not provide phone support, but still essential in case we need to contact you. Thanks for providing it from the beginning! - Check the quality of every document uploaded such as the ID or letters while zooming in.

We don’t want to send money to someone other than you. Also, to avoid our compliance team suffering from headaches at the end of the day, we kindly ask you to provide good quality scans.

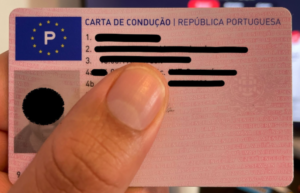

This is perfect:

Sorry, but this is not:

Sorry, but this is not:

- If you upload an ID, driver license or local ID, always remember to upload the front and back.

One side isn’t enough to verify the authenticity of the proof of identity. - Proof of address always relates to the business address and needs to be issued within the past 12 months (utility bill or governmental letter only).

- The Bank Statements uploaded need to be issued within the past three months.

No to worry, we are not interested in the liquidity of your business. Feel free to blur out numbers or names in the statements. Apart from your bank account details of course.

Don’ts

- Don’t upload an identification with covered information

We have seen it all: Thumbs and even toes on the pictures of the proof of identity. It is better to scan it. Although we believe you have beautiful hands and feet, they are not a requirement for the KYC process.

- Don’t use abbreviations such as A J Doe as the name is Anthony Jonas Doe.

Banks do not consider abbreviations while making payments on automated systems (we definitely don’t want your money to be blocked, right?). - Don’t click “confirm” too fast at the end of the KYC process.

We recommend double checking all the information and documents uploaded. It is essential that the information for the whole process, from the onboarding to your first payout, needs to be entered correctly and matching. The faster we can approve your account, the faster you receive your money. A benefit for both parties, isn’t it?

The KYC process might look like an unconquerable mountain but we promise you once you started, it’s even easier to finish.

Do you have feedback about our KYC process? Don’t hesitate to tell us! support@payyo.ch