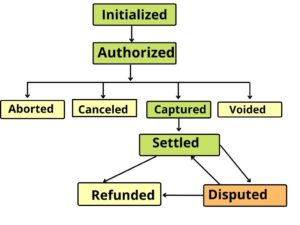

When checking the transaction details you will find a status for each transaction. Here you find the description of what the status means.

The normal cycle of a transaction

INITIALIZED

The payment has been initialized by the cardholder by clicking “pay now” but the payment process has not been finished. No amount has been taken from the customer but it can be blocked.

AUTHORIZED

The amount related to the transaction is blocked and available to be captured. This is an automatic process. The money is held by the customer’s bank.

CAPTURED

The amount has been captured but is still waiting for the bank settlement. This process normally takes a few seconds but some APM are not settled right away. Direct Debit transactions can take a few days until the transaction has the final settled call by the acquirer.

SETTLED

The transaction has successfully occurred and the amount is in the merchant’s account.

Exceptions

ABORTED

The transaction was initiated by the cardholder but the process was never completed. The payment process was either stopped or failed. No amount has been taken but it can be blocked for some hours in the customer’s account.

CANCELLED

After capturing and instead of settling the transaction, it was cancelled. The most common reason for a transaction to be cancelled is that the API call from the payment gateway failed.

VOIDED

A transaction has been cancelled before it is processed to the customer’s credit or debit card account. A transaction can only be voided if it has been authorized but not settled.

Change of transaction status

After a transaction was successfully settled there can be this transaction status:

DISPUTED

A disputed transaction is a debit or credit card transaction that the cardholder or the issuer bank is claiming is illegitimate in some way. They may claim the purchase was fraudulent, not recognize it, they didn’t receive what they paid for, or the amount was incorrect.

REFUNDED

The service did not occur or was cancelled. A refund has been done by the merchant or by their request.